Nowadays, all banks have to verify whether every applicant is eligible to be given a loan.To avoid all these doubts, have a good budget with proper financial projections.

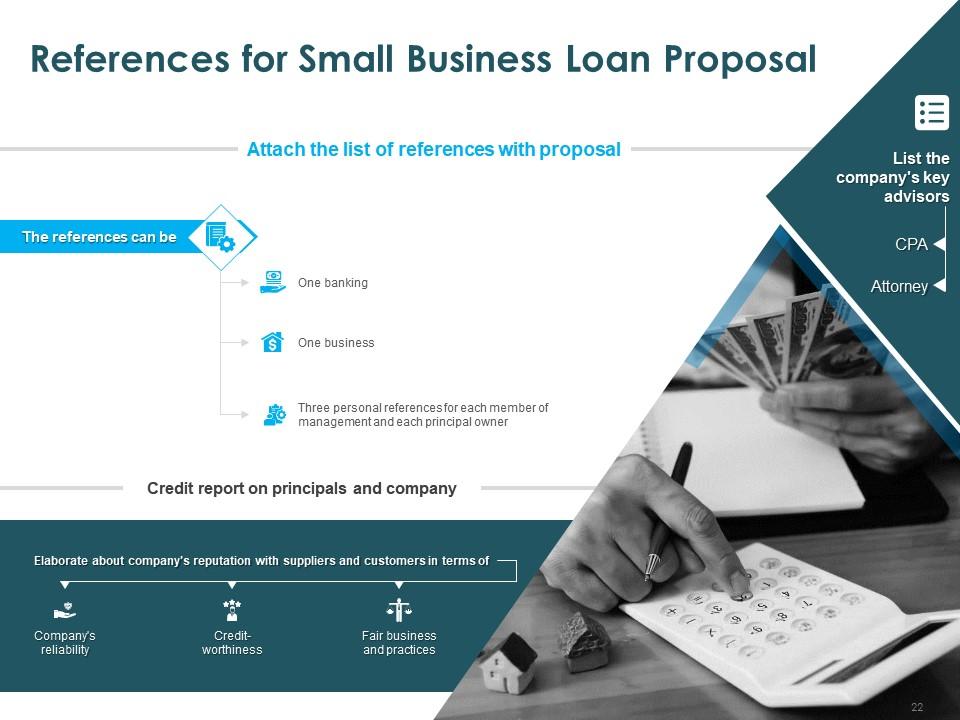

Overestimating on the other hand makes the bank question whether a thorough research was done before writing the business plan. This is due to the fact that underestimating could lead to financial problems in the future. When applying for a loan, it is good to do a thorough research in order for you not to underestimate or overestimate the amount of money you require.Thus, stating what your loan will be used for makes it easy for the bank to determine whether the amount applied for will meet all your needs. On the other hand, if you want funds to keep the business running before your debtors pay you, it would be advisable to apply for a short-term loan. If you want to purchase equipment for example, you need to apply for an equipment loan. Banks have a tendency to assess how the loan applicant wants to spend the funds borrowed. State how you want to spend your finances.Remember a great business plan means that the business is likely to succeed according to the mind of the lender. A business plan should be able to state the business' goals, mission and how it will be run in order to achieve all the objectives stated. It forms an introduction about who you are and what your business is all about. In order to secure a loan, many banks need you to have a strong financial plan which brings out what your business entails.This is to encourage more economic activity in the country. Strong bank statements will be demanded.Įven so, the process of getting one without an ITR is a lot easier than it was in the past.The interest rate is going to be substantially higher.The tenure to pay the loan amount is going to be shorter.The main things to be kept in mind, when choosing to apply for a business loan without an ITR is that: This has been done, mainly, keeping in mind that a large sector of these new businesses will be started by individuals who have not previously owned any business. As small scale trade is escalating, with more start-ups coming up every day, the options for business loans being available without an ITR to have gone up.

In most cases, even when an ITR does not have to be presented to the bank to get a business loan, a bank statement of the current account is demanded for a minimum of a period of 12 months.īusiness loans that are granted without having to present an ITR are mainly tailored for small scale trade. Providing personal property as collateral, when it comes to applying for a business loan without ITR or otherwise, makes the process easier. This further eases the process of getting a loan without an ITR.

The importance of ITRĪn ITR is a document that serves as proof of income. Barring this, various banking facilities, such as ourselves, readily offer loans without need for an ITR to be filed. Getting business loans without an ITR is possible in today’s market – a significant con- they come at higher interest rates.

0 kommentar(er)

0 kommentar(er)